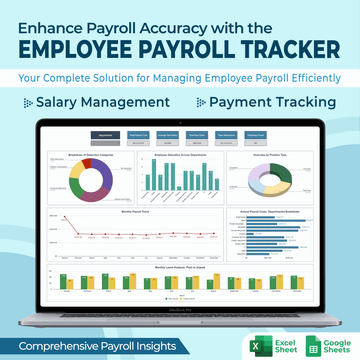

Employee Payroll Tracker

✔ Visual insights into payroll and leave trends.

✔ Centralized employee data for quick and easy access.

✔ Simplified overtime and leave management system.

Employee Payroll Tracker

What Our Customers Say About This Tool

Scope and Features Review

Google Sheets & Excel Versions

Dashboard Tab (A)

Overview of Key Metrics

✔ KPI Overview: Track key metrics like payroll costs, employee count, and deductions at a glance.

✔ Departmental Analysis: Visualize payroll expenses across departments for better financial insights.

✔ Position Type Overview: Analyze payroll distribution by job role for better workforce planning.

Dashboard Tab (B)

Monthly Trends and Leave Analysis

✔ Monthly Payroll Trends: Track monthly payroll fluctuations over time.

✔ Leave Insights: Compare paid vs unpaid leave for patterns.

✔ Actionable Data: Use graphical insights to adjust payroll strategy effectively.

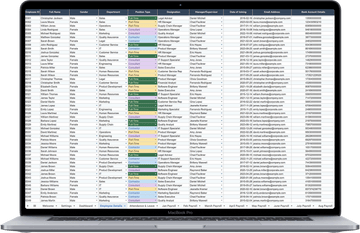

Employee Details Tab

Manage Employee Information

✔ Centralized Database: Maintain a well-organized record of all employee personal and job details.

✔ Dropdown Inputs: Streamline data entry with preset dropdowns.

✔ Updatable Records: Quickly modify employee details as needed for up-to-date records.

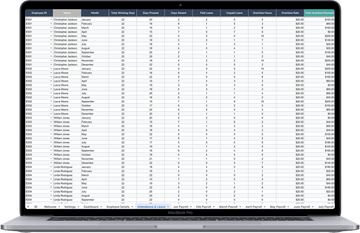

Attendance & Leave Tab

Track Attendance and Overtime

✔ Attendance Logs: Track attendance, leave, and overtime automatically.

✔ Overtime Calculations: Calculate overtime payments automatically based on logged hours.

✔ Leave Insights: Generate reports on leave patterns to optimize staffing and planning.

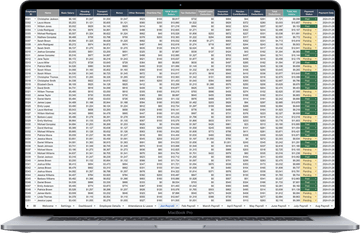

Monthly Payroll Tab

Automate Payroll Calculations

✔ Monthly Payroll Tracking: Prepare and track monthly payroll for each employee.

✔ Deductions and Allowances: Track bonuses, overtime pay, tax deductions, and more for accurate net salary.

✔ Status Monitoring: Quickly identify whether payments are completed or pending with a status tracker.

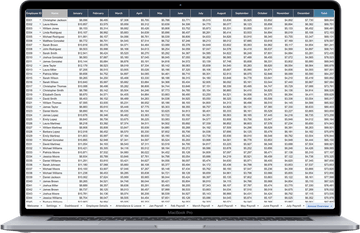

Annual Overview Tab

Yearly Payroll Summary

✔ Yearly Payroll Summary: View total net salary for each employee.

✔ Financial Overview: Automatically generate annual payroll reports.

✔ Reporting Efficiency: Save time with automated annual summaries.

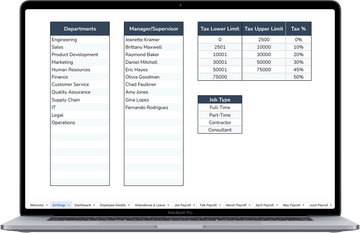

Settings Tab

Configure Payroll Foundations

✔ Custom Department Setup: Easily define and categorize departments for payroll.

✔ Flexible Tax Configuration: Automate complex tax calculations with customized brackets.

✔ Job Type Management: Set job types (full-time, part-time, contractor) for accurate payroll data.